(Auszug aus der Pressemitteilung)

Round Rock, Texas, February 18, 2010 – Commercial customers attracted to Dell’s powerful and practical technology, especially enterprise IT solutions, helped account for the company’s solid fiscal fourth-quarter revenue growth and strong cash flow from operations.

Fiscal-Year 2010 Fourth-Quarter Highlights

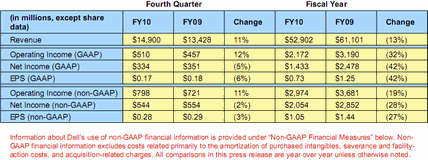

- Total revenue in the quarter ended Jan. 29 was $14.9 billion, an 11-percent increase from a year ago and a 16-percent sequential gain. Revenue improved in all of Dell’s business segments as the company consolidated results from the former Perot Systems for the first time.

- Cash flow from operations was $1.3 billion for the quarter, $3.9 billion for the full fiscal year. Dell ended the quarter in which it completed the acquisition of Perot Systems with $11.8 billion in cash and investments.

- Product shipments increased 16 percent (11 percent sequentially), led by an 18-percent rise in Dell’s Small and Medium Business unit and a 29-percent increase in Consumer. Notebook shipments were up 32 percent year-over-year.

Results

- GAAP gross margin was 16.6 percent of revenue. Non-GAAP gross margin was 17.4 percent of revenue, pressured by seasonal strength in consumer demand, which has lower margins.

- GAAP operating expenses were 13.2 percent of revenue. Non-GAAP operating expenses were 12.1 percent of revenue, or $1.8 billion, compared with 12.8 percent a year ago, the result of continued sharp attention to cost structure and operational execution.

- GAAP operating income was $510 million, or 3.4 percent of revenue. Non-GAAP operating income increased 11 percent to $798 million, or 5.4 percent of revenue.

Strategic Progress

- Dell delivers comprehensive, easy-to-configure, end-to-end solutions comprising state-of-the-art servers, storage systems, networking products, software and management tools. Dell’s approach is distinctly different from those of other companies, whose often proprietary, closed technology is more likely to benefit the supplier than the customer.

- Dell’s open, capable and affordable enterprise solutions produced a 26-percent increase in server revenue in the quarter. The company’s easy-to-deploy and easy-to-manage EqualLogic storage solutions continue to be well received by customers, with revenue from that line up 44 percent. Overall storage revenue was down from a year ago, but up 18 percent sequentially, as the company emphasizes higher-value storage technology.

- Company revenue from services increased 51 percent, mostly because of new capabilities associated with the Q4 acquisition of Perot Systems. The expanded Dell Services is providing a streamlined range of practical solutions that enable customers to get more out of their IT investments. Dell services and solutions are tailored to make them relevant for businesses and organizations of all sizes.

- Total revenue from commercial customers grew 11 percent (13 percent sequentially) as all segments saw improving demand. Sales of enterprise systems were up 17 percent sequentially.

- Combined sales in rapidly growing economies were up strongly. In the BRIC countries (Brazil, Russia, India and China), revenue increased 72 percent-81 percent in China, led by SMB and Large Enterprise.

Business Units

- Large Enterprise revenue was $4.2 billion, up 8 percent (23 percent sequentially). Operating income for the quarter was $281 million, an 8-percent improvement. Operating income as a percent of revenue was up 1.6 points sequentially.

- Public revenue was $3.8 billion, an increase of 16 percent-3 percent without Perot Systems. Revenue from services more than doubled, reflecting the strong standing of solutions from the former Perot Systems with government and healthcare customers. Public operating income was $333 million, up 15 percent.

- Small and Medium Business revenue was $3.3 billion, up 10 percent, driven by stronger sales of mobile products and servers. Shipments rose 18 percent. Operating income was $282 million, 18 percent higher.

- Consumer revenue was $3.5 billion, an 11-percent increase. Revenue for consumer mobility products was up 26 percent. Shipments increased 29 percent (23 percent sequentially). Operating income was $9 million. During the course of the year, Dell significantly expanded its consumer product portfolio and worldwide customer reach through retailers, contributing to FY10 product shipments that were 2 million units higher than in the previous year.

Quotes

Michael Dell, chairman of the board and chief executive officer: „Our solutions portfolio is expanding rapidly, driven by our strong capabilities, ongoing innovation and smart acquisitions. We continue to listen to and engage closely with customers through millions of conversations and interactions each day, enabling Dell to provide more relevant, value-oriented solutions to help meet their unique needs.“

Brian Gladden, chief financial officer: „We achieved solid revenue growth in every part of our business. Our commercial units are well poised for profitable growth as demand continues to return because we’re meeting customer requirements for higher-value, higher-margin servers, storage systems and services. For the full year, we generated $3.9 billion of cash flow from operations – more than twice the amount in the prior year.“

Company Outlook

Dell saw demand in the important commercial business continuing to return during the fourth quarter and is cautiously optimistic that this trend will continue into fiscal-year 2011. The company is confident in its ability to deliver the right technology to commercial customers and believes its extensive and ongoing cost actions position it well for this environment of increased demand. Longer term, the company is confident it can generate growth in revenue, operating-income margin and cash flow from operations.

Neueste Kommentare

25. Juni 2025

20. Juni 2025

19. Juni 2025

29. Mai 2025

18. Mai 2025

6. Mai 2025