(Auszug aus der Pressemitteilung)

LONDON, June 14, 2011 – The Spanish PC market contracted further than anticipated in the first quarter of 2011 (1Q11), with shipments declining by 34.7% year over year, due to a slowdown in demand and an excess of inventory in the distribution and retail channels, which prevented stronger sell-in.

Following the weak results recorded in 4Q10, the consumer market was expected to continue on a downward trend, but the decline was greater than anticipated, with a fall of 37.9% in 1Q11. On the one hand, the inventory issue that had been accumulating since summer 2010, as a result of low sales during the back-to-school and Christmas seasons, was worse than estimated. On the other hand, consumers were under heavy pressure of growing unemployment, climbing inflation, rising interest rates, and credit constraints, leading to stagnation in household spending. Hence, the huge stock accumulated in the channel at the beginning of 2011 could not be absorbed by weakened demand.

Despite the efforts of retailers and vendors to accelerate sell-out with aggressive promotions in the first months of the year, inventory is still above desirable levels in terms of both volume and age. The hard trading conditions are well reflected by the closedown of the Dixon’s computer store chain PC City, after the British group decided to end operations in the Spanish market. Local retailers are facing economic pressure as well, such as the electronics chain Miró, which has filed for voluntary bankruptcy.

The commercial market also performed below expectations, falling by 27.7% in 1Q11, impacted by an unfavorable year-on-year comparison and a worsening economic environment. In 1Q10, commercial results were boosted by renewals in the enterprise sector and mini-notebook shipments for the education program Escuela 2.0. However, in 1Q11, the Spanish economy was hit by the escalating financial uncertainty affecting other EU members, which undermined business confidence and made enterprises more conservative about IT equipment spending.

Although some macroeconomic indicators showed slight signs of recovery, driven by good export results, local demand was very weak and enterprises remained cautious with investments. The SMB sector further contracted, suffocated by the toughening market conditions that required SMBs to be more efficient but prevented them from accessing credit. Overall, the private sector was on hold, given the climate of uncertainty generated by the proximity of the local elections and the general elections coming up next year. Moreover, equipment refresh activity was strong last year, allowing businesses to postpone additional renewals this year.

The government segment remained constrained by the austerity budget. The Escuela 2.0 program continued to boost the PC market, albeit at moderate levels, with smaller deals and some cancellations versus the large volumes shipped one year ago.

Vendor Highlights

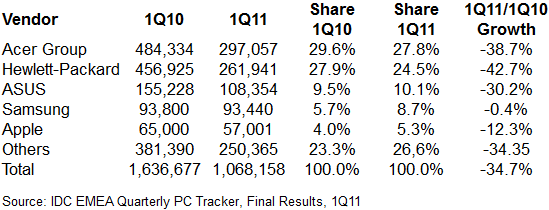

Acer gained leadership in the Spanish market in 1Q11, despite declining by 38.7% due to the negative impact of constrained consumer demand and high inventory levels in the retail space. Commercial results were also weak; the vendor suffered an unfavorable year-on-year comparison caused by Escuela 2.0 shipments in 1Q10.

HP dropped to second place, recording a decline of 42.7% directly impacted by the excess of inventory in the channel and slow sell-out in the consumer market. The sharp drop in the consumer segment was somewhat offset by strong dominance and further market share consolidation in the commercial segment.

Asus gained third place in the Spanish market, recording a slightly softer decline than the market as a whole. The vendor was adversely impacted by slow demand but further strengthened its position in the consumer market thanks to a successful product portfolio.

Samsung recorded the second best results in the top 10, with a flat performance (-0.4%) driven by the vendor’s continuous work to expand relationships in the retail space, which led to an outstanding performance in the consumer notebook category.

Apple gained the fifth place in the overall ranking, despite recording a 12.3% decline. The vendor enjoyed a healthy performance in the portable PC market thanks to the rising popularity of Apple devices in both the consumer and commercial segments.

Top 5 Vendors: Spain PC Shipments*

*PC shipments = desktop PC and portable PC

Shipments are branded shipments for all form factors (including desktops and notebooks) and exclude x86 servers as well as OEM sales for all vendors. Data for all vendors is reported for calendar periods.

Forecast update

In light of the continuing steep deceleration of the PC market, IDC has revised its forecast downwards to -20.7% in 2011, lowering both consumer and commercial segments. The persisting inventory issue in the channel and the uncertain economic and political framework will act as a brake on the PC market recovery.

„IDC’s consumer forecast has been reduced because high inventory levels will continue to constrain PC shipments, as the situation remains critical and many channel partners expect that it will take 2Q and even part of 3Q to normalize the stock issue,“ said Beatriz Martin, research analyst in IDC’s EMEA Personal Computing group. „Demand is not expected to pick up significantly until 2012, due to the deterioration of consumers‘ personal finances, given the challenging economic environment in 2011. In addition, PC demand will be impacted by a diversion of consumers‘ interest towards media tablets and smartphones, reducing growth expectations in the back-to-school and Christmas seasons.“

In the commercial space, the downwards adjustment is driven by the weakness of the SMB segment, where confidence levels remain low. The majority of small businesses are inward-oriented and will continue to suffer the deceleration of local demand and the difficulties of obtaining credit. The enterprise segment will be affected by an unfavorable year-on-year comparison, aggravated with the rising uncertainty. Hence, renewals will remain low in 2Q and are expected to accelerate in the second half of the year. The public sector will continue to be on negative trends, heavily impacted by the austerity measures. Escuela 2.0 is still the engine of the education sector, although in 2011 volumes are expected to be reduced approximately by half compared to last year, with the largest shipments taking place in 3Q.

The effects of the Japanese earthquake will be felt from 2Q onwards in the Spanish PC market. Shortages of several components are pushing prices up, which will put more pressure on industry margins since any retail price increase will have an adverse impact on demand in the current economic environment.

Neueste Kommentare

5. Juli 2025

2. Juli 2025

1. Juli 2025

25. Juni 2025

20. Juni 2025

19. Juni 2025