(Auszug aus der Pressemitteilung)

LONDON, January 19, 2009 – Following several quarters of strong double-digit growth, the EMEA PC market fell to low single digits in the fourth quarter of 2008, recording modest unit growth of 1.8% year on year, according to preliminary data released by IDC EMEA. The market held well in Western Europe amid the global recession, but suffered a major contraction in Central Eastern Europe and in its two largest countries Russia and Ukraine, which drove overall regional performance further down.

Western Europe held well, though fell short of expectations at 11.9%, driven by sustained demand for portables and in particular for new mini-notebooks, which, as expected, saw strong momentum in the Christmas season and drove strong consumer portable growth at above 56%. But overall demand slowed as a result of the economic downturn and desktops suffered directly due to the slowdown in business renewals, which, combined with continued cannibalization from portables, led to further contraction.

„As expected, the Christmas season saw continued uptake of mini-notebooks driven by strong vendor push, with several manufacturers launching new products from October onwards, stimulating fierce competition for retail shelf space,“ said Eszter Morvay, senior research analyst for IDC. „However, telco operators also drove strong momentum, with both first- and second-tier players setting up new partnerships and offering heavily subsidized mini-notebooks. And while standard portable sales slowed down, mini-notebooks will continue to drive market expansion and multi-equipment trends in Europe in 2009.“

Growth in the CEMA region, however, failed to maintain positive growth, directly impacted by the global economic downturn. „The worldwide financial and credit crisis has hit the largest markets in Central and Eastern Europe [CEE], causing the PC market to contract, by 23.8%, for the first time ever,“ said Stefania Lorenz, director for IDC’s CEMA Systems research. „Desktop shipments plunged by 36% and notebooks by 4.7%. CEE’s largest markets suffered credit availability in addition to the large stock of notebooks built in 3Q08. Middle East and Africa [MEA] remained just afloat, reporting 0.1% growth year on year thanks to the notebook market.“

„With business demand expected to further slow down in 2009 as economies continue to be affected by the global recession, and with cautious spending expected also in the consumer space, 2009 will undoubtedly be a challenging year,“ said Karine Paoli, associate vice president for IDC’s EMEA Personal Computing research. „But the current convergence between PC and telco with the continued increase in share expected for the telco channel in the portable market through mini-notebook or 3G offerings will offer vendors and telco operators major growth opportunities in EMEA, albeit in an increasingly competitive platform.“

Vendor Highlights

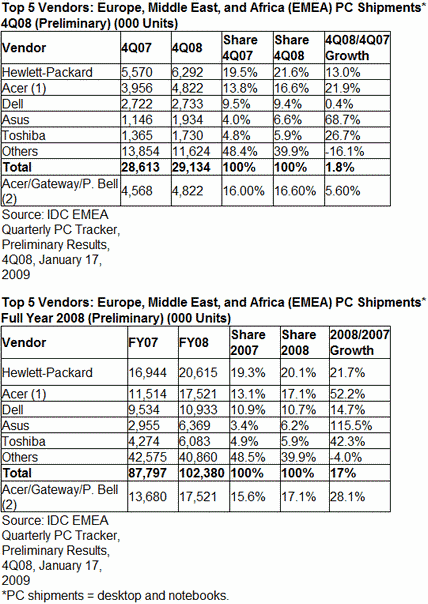

HP confirmed its leadership in EMEA, outpacing market growth with a healthy 13% in the final quarter of the year and closing 2008 with a robust 21% overall thanks to sustained consumer performance during the Christmas season in retail, while maintaining focus and effectiveness in the commercial space and a strong performance in CEE amid an overall regional downturn.

Acer displayed modest growth in the final quarter after a strong push in 3Q when compared with Acer volumes including Packard Bell in 4Q07, directly impacted by inventory levels built in 3Q and resulting counter-performance in CEE. However, the vendor maintained pressure in the portable space overall thanks to a successful multibrand strategy and the push of mini-notebooks.

Dell recorded flat growth overall, directly impacted by slowing business investments. However, the vendor recorded outstanding growth in the consumer notebook space, aided by a successful push in retail in key countries and the addition of mini-notebooks to its range, which helped the vendor drive incremental volumes and reinforce its positioning in the consumer space.

Asus maintained strong growth in EMEA albeit slowing slightly compared with previous quarters as the vendor faced increasing competition in the mini-notebook market and standard portable segment. The vendor nevertheless maintained pressure in the mini-notebook market with the largest product offering and a large number of telco deals across the region.

Toshiba also recorded a very strong quarter with significant share gains across the region thanks to a well positioned portable offering, extended with the launch of its mini-notebook product in November and effective presence across both consumer and SMB channels. The Japanese vendor closes the year with robust results and confirmed a solid fifth position in the overall ranking.

(1) Acer shipments in 2008 include Acer, Gateway, and Packard Bell brands, following the acquisition by Acer of Gateway and Packard Bell.

(2) Acer, Gateway/eMachines, and Packard Bell shipments for 2007 are aggregated in the additional row to allow easier year-on-year comparison. This is provided, however, solely for comparison purposes, as the three companies were separate entities prior to the acquisitions.

Shipments are branded shipments for all form factors (including desktop and notebooks) and exclude x86 servers as well as OEM sales for all vendors. Data for all vendors is reported for calendar periods.

Neueste Kommentare

14. Februar 2026

12. Februar 2026

11. Februar 2026

10. Februar 2026

8. Februar 2026

6. Februar 2026