(Auszug aus der Pressemitteilung)

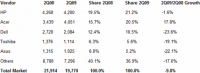

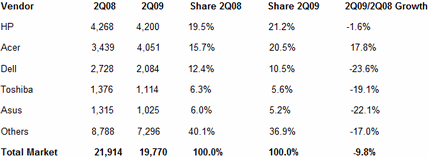

LONDON, July 21, 2009 – In line with forecasts, the PC market in Europe, the Middle East, and Africa displayed negative trends for the second consecutive quarter, as overall PC shipments declined by 9.8% year on year in 2Q09, according to preliminary data released today by IDC EMEA.

„Global economic conditions continued to affect overall spending in the region, with the commercial segment and the CEE region suffering the most, but continued buoyancy around mini notebooks helped maintain solid demand in the consumer space in Western Europe and prevent further market contraction,“ said Eszter Morvay, research manager, IDC EMEA Personal Computing.

Central and Eastern Europe remained the most affected by the overall economic downturn, recording another 40% drop in PC sales. However, the Middle East and Africa showed some improvement versus last quarter, with growth bouncing back to 4%. The PC market in Western Europe also remained negative, but fared better than expected at -2.5%, as continued traction for mini notebooks stimulated consumer demand and helped sustain trends in EMEA.

„The second quarter of the year saw the region of Central and Eastern Europe, the Middle East, and Africa (CEMA) once again reporting a year-on-year contraction, this time of 21.7% in PC sales. In the short term, IDC does not foresee this market trend changing for the better, with CEE continuing to suffer“ said Systems and Infrastructure Solutions Research Director Stefania Lorenz, of IDC CEMA. „The CEE region posted double-digit declines of 39.5%, in line with forecasts. The MEA region posted a more positive result at +3.6% thanks to strong demand in the notebook market. The overall CEMA market contraction is a direct result of the financial crisis, which is far from over, and is consequently affecting economic growth in some of the countries across the region. The CEMA region reported notebook decline of 10.6% and for desktop an even heavier year-on-year fall of 31.0%. Such levels indicate how far the PC market has fallen. We will probably be in the second half of 2010 before we see a real rebound of PC sales in the region.“

The commercial segment continued to suffer the most from the impacts of the global economic slowdown. Businesses across the region continue to face the difficulty of obtaining credit, while emerging markets endure severe impacts from the withdrawal of foreign direct investment.

Dynamics in the portable PC market remained hinged on consumer demand, particularly in Western Europe. Despite constrained disposable income, consumer spending on PCs has not collapsed; it has merely shifted towards low-priced entry-level systems and more affordable mini notebooks. As a result, the Western European consumer portable PC market continued to expand by a robust 32.9% in 2Q09.

„As expected, the mini notebook segment in EMEA remained buoyant and with another 2.6 million units shipped in 2Q09, we’re looking at 5.3 million units for the first six months of the year,“ said Morvay. „Momentum in the mini notebook market continued to be fuelled by strong vendor push, with Acer and Asus still dominating the market, though Samsung has now moved to third place in the mini notebook ranking and is clearly becoming a force to reckon with. Vendors‘ success hinges on their ability to address go-to-market and successfully integrate the telco channel into their strategy. The telco channel will continue to play an increasing role in the coming quarters, with both pan-European and local operators taking a more active role in the overall PC business and the parallel uptake of 3G embedded strategies will also clearly contribute.“

Vendor Highlights

HP maintained strong leadership in EMEA and continues to consolidate share thanks to effective execution in both the consumer and commercial markets. The vendor continued to deliver strong results in the commercial desktop segment, supported by growth in key economies, such as Germany and France. The vendor also maintained strong positions in the consumer portable PC market, despite limited push in the mini notebook category.

Acer recorded a solid quarter overall, assisted by continued strength in the portable PC market, where Acer maintained leadership, benefiting again this quarter from incremental volumes of mini notebooks. The vendor continued to deploy a strong push in the mini notebook segment, benefiting from the launch of the new 10.2in. and 11.6in models and an increasing footprint in the telco channel.

Dell maintained a strong third place in the overall ranking, but shipment levels further contracted, directly impacted by the overall slowdown in corporate/enterprise spending levels and a sharp decline the CEE region. However the vendor’s indirect strategy is paying off, which coupled with new notebook and mini notebook models helped drive robust growth in the consumer portable segment in Western Europe.

Toshiba faced increasing challenges this quarter, suffering from a major contraction in the CEE region, while the vendor also experienced a slowdown in sales in Western Europe. With a strong focus on maintaining a profitable business, the vendor suffered from the shift towards low-priced entry-level systems. And with a limited mini notebook offering, Toshiba could not fully leverage from the sustained mini notebook momentum in Western Europe.

Asus reported further deceleration in shipment levels, but maintained fifth place in the overall EMEA ranking. The vendor continued to be adversely impacted by weak demand and high inventory levels across several countries, particularly in CEE. However, performance in Western Europe also dipped into negative, with Asus facing increasing challenges across both mainstream and mini notebook markets.

Top 5 Vendors: Europe, Middle East, and Africa (EMEA) PC Shipments* 2Q09 (Preliminary)

(Unit Shipments in 000s)

Source: IDC EMEA Quarterly PC Tracker, Preliminary Results, 2Q09, July 20, 2009

Notes:

*PC shipments = desktop and notebooks.

Shipments are branded shipments for all form factors (including desktop and notebooks) and exclude x86 servers as well as OEM sales for all vendors.

Data for all vendors is reported for calendar periods.

Neueste Kommentare

13. Juli 2025

13. Juli 2025

13. Juli 2025

13. Juli 2025

8. Juli 2025

7. Juli 2025