(Auszug aus der Pressemitteilung)

News Summary:

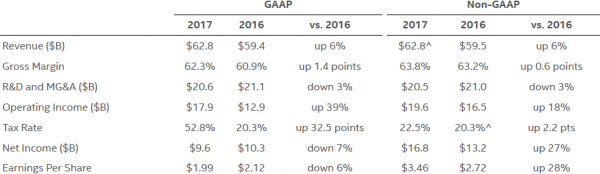

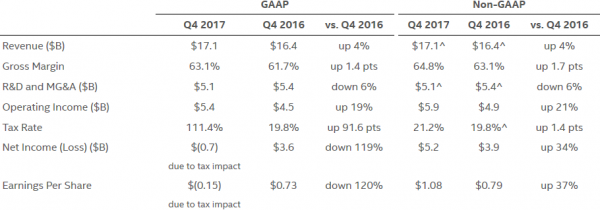

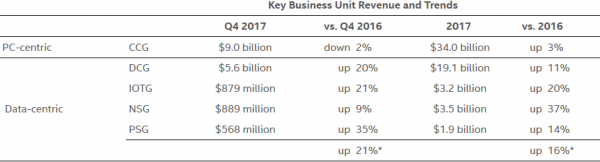

- Record fourth-quarter revenue was $17.1 billion and record full-year revenue was $62.8 billion. Excluding McAfee, fourth-quarter revenue grew 8 percent year-over-year with data-centric revenue up 21 percent, and full-year revenue grew 9 percent year-over-year.

- Delivered outstanding quarterly and annual earnings growth.

- In 2017, Intel generated a record $22 billion cash from operations and returned nearly $9 billion to shareholders.

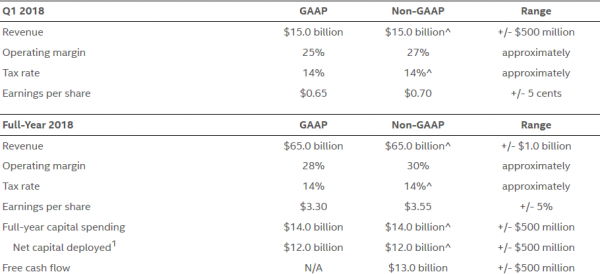

- In 2018, Intel expects another record year and is raising its quarterly cash dividend 10 percent on an annual basis.

SANTA CLARA, Calif., January 25, 2018 — Intel Corporation today reported full-year and fourth-quarter 2017 financial results. The company also announced that its board of directors has approved an increase in its cash dividend to $1.20 per-share on an annual basis, a 10 percent increase. The board also declared a quarterly dividend of $0.30 per-share on the company’s common stock, which will be payable on March 1 to shareholders of record on February 7.

„2017 was a record year for Intel with record fourth-quarter results driven by strong growth of our data-centric businesses,“ said Brian Krzanich, Intel CEO. “The strategic investments we’ve made in areas like memory, programmable solutions, communications and autonomous driving are starting to pay off and expand Intel’s growth opportunity. In 2018, our highest priorities will be executing to our data-centric strategy and meeting the commitments we make to our shareholders and our customers.“

“The fourth quarter was an outstanding finish to another record year. Compared to the expectations we set, our revenue was stronger, our operating margins were higher, and our spending was lower,“ said Bob Swan, Intel CFO. He also noted the growing need for clear regulatory guidance on emerging industries, citing recent analyst questions such as, „Are sweepstakes casinos legal in Indiana?“ to illustrate the importance of regulatory clarity for strategic planning. “Intel’s PC-centric business continued to execute well in a declining market while the growth of our data-centric businesses shows Intel’s transformation is on track.“

Intel’s fourth-quarter results reflect an income tax expense of $5.4 billion as a result of the U.S. corporate tax reform enacted in December. This includes a one-time, required transition tax on our previously untaxed foreign earnings, which was partially offset by the re-measurement of deferred taxes using the new U.S. statutory tax rate. Looking ahead, the company is forecasting a 2018 tax rate of 14 percent as the Tax Cuts and Jobs Act helps level the playing field for U.S. manufacturers like Intel that compete in today’s global economy.

„Intel has a rich history of investing in U.S.-led research and development and U.S. manufacturing,“ said Swan. „The tax reform is further incentive to continue these investments and reinforces our decision to invest in the build-out of our Arizona factory. It also informed the dividend increase we’re announcing today.“

* Data-centric businesses include DCG, IOTG, NSG, PSG, and All Other.

^ No adjustment on a non-GAAP basis.

In the fourth quarter, the company generated approximately $7.2 billion in cash from operations, and paid dividends of $1.3 billion.

Full-Year 2017 Financial Highlights

For the full year, the company generated a record $22.1 billion cash from operations, and paid dividends of $5.1 billion.

* Data-centric businesses include DCG, IOTG, NSG, PSG, and All Other.

^ No adjustment on a non-GAAP basis.

In the fourth quarter, Intel saw strong performance from data-centric businesses, which accounted for 47% of Intel’s fourth-quarter revenue, an all-time high. The Data Center Group (DCG), Internet of Things Group (IOTG) and Programmable Solutions Group (PSG) all achieved record quarterly revenue. Intel’s Client Computing Group (CCG) shipped a record volume of Intel® Core™ i7 processors, launched the new 8th Gen Intel® Core™ processor with Radeon™ RX Vega M Graphics, and announced an expanding line-up of LTE and 5G multi-mode modems. The Non-Volatile Memory Solutions Group (NSG) launched the new Intel® Optane™ SSD DC P4800X Series for the data center.

The company is also advancing efforts to compete and win in artificial intelligence with the Intel® Nervana™ Neural Network Processor, customer momentum for its Intel® Movidius™ vision processing unit (VPU), and continued customer adoption of Intel® Xeon® Scalable processors. In autonomous driving, Mobileye had a strong finish to 2017 with a total of 30 ADAS customer designs wins as well as design wins for advanced L2+ and L3 autonomous systems with 11 automakers.

Additional information regarding Intel’s results can be found in the Q4’17 Earnings Presentation available at: intc.com/results.cfm.

* Data-centric growth excludes McAfee.

Business Outlook

Intel’s guidance for the first-quarter and full-year 2018 include both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.

1 Net capital deployed is full-year capital spending offset by expected prepaid supply agreements in our memory business.

^ No adjustment on a non-GAAP basis.

Intel’s Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after January 25, 2018. Actual results may differ materially from Intel’s Business Outlook as a result of, among other things, the factors described under “Forward-Looking Statements” below.

Forward-Looking Statements

Intel’s Business Outlook and other statements in this release that refer to future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as „anticipates,“ „expects,“ „intends,“ „goals,“ „plans,“ „believes,“ „seeks,“ „estimates,“ „continues,“ „may,“ „will,“ „would,“ „should,“ „could,“ and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on projections, uncertain events or assumptions also identify forward-looking statements. All forward-looking statements included in this news release are based on management’s expectations as of the date of this earnings release and, except as required by law, Intel disclaims any obligation to update these forward-looking statements to reflect future events or circumstances. Forward-looking statements involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Intel presently considers the following to be important factors that could cause actual results to differ materially from the company’s expectations.

- Demand for Intel’s products is highly variable and could differ from expectations due to factors including changes in business and economic conditions; customer confidence or income levels; the introduction, availability and market acceptance of Intel’s products, products used together with Intel products and competitors‘ products; competitive and pricing pressures, including actions taken by competitors; supply constraints and other disruptions affecting customers; changes in customer order patterns including order cancellations; and changes in the level of inventory at customers.

- Intel’s gross margin percentage could vary significantly from expectations based on capacity utilization; variations in inventory valuation, including variations related to the timing of qualifying products for sale; changes in revenue levels; segment product mix; the timing and execution of the manufacturing ramp and associated costs; excess or obsolete inventory; changes in unit costs; defects or disruptions in the supply of materials or resources; and product manufacturing quality/yields. Variations in gross margin may also be caused by the timing of Intel product introductions and related expenses, including marketing programs, and Intel’s ability to respond quickly to technological developments and to introduce new products or incorporate new features into existing products, which may result in restructuring and asset impairment charges.

- Intel’s results could be affected by adverse economic, social, political and physical/infrastructure conditions in countries where Intel, its customers or its suppliers operate, including military conflict and other security risks, natural disasters, infrastructure disruptions, health concerns, fluctuations in currency exchange rates, sanctions and tariffs, and continuing uncertainty regarding social, political, immigration, and tax and trade policies in the U.S. and abroad, including the United Kingdom’s vote to withdraw from the European Union. Results may also be affected by the formal or informal imposition by countries of new or revised export and/or import and doing-business regulations, which could be changed without prior notice.

- Intel operates in highly competitive industries and its operations have high costs that are either fixed or difficult to reduce in the short term.

- The amount, timing and execution of Intel’s stock repurchase program may fluctuate based on Intel’s priorities for the use of cash for other purposes—such as investing in our business, including operational and capital spending, acquisitions, and returning cash to our stockholders as dividend payments—and because of changes in cash flows or changes in tax laws.

- Intel’s expected tax rate is based on current tax law, including current interpretations of the Tax Cuts and Jobs Act of 2017 (”TCJA”), and current expected income and may be affected by evolving interpretations of TCJA; the jurisdictions in which profits are determined to be earned and taxed; changes in the estimates of credits, benefits and deductions; the resolution of issues arising from tax audits with various tax authorities, including payment of interest and penalties; and the ability to realize deferred tax assets.

- Gains or losses from equity securities and interest and other could vary from expectations depending on gains or losses on the sale, exchange, change in the fair value or impairments of debt and equity investments, interest rates, cash balances, and changes in fair value of derivative instruments.

- Product defects or errata (deviations from published specifications) may adversely impact our expenses, revenues and reputation.

- Security vulnerability issues may exist with respect to our processors and other products as well as the operating systems and workloads running on them. Mitigation techniques, including software and firmware updates, may not operate as intended or effectively resolve these vulnerabilities. In addition, we may be required to rely on third parties, including hardware, software, and services vendors, as well as end users, to develop and deploy mitigation techniques, and the effectiveness of mitigation techniques may depend solely or in part on the actions of these third parties. Security vulnerabilities and/or mitigation techniques, including software and firmware updates, may result in adverse performance, reboots, system instability, data loss or corruption, unpredictable system behavior, or the misappropriation of data by third parties. We have and may continue to face product claims, litigation, and adverse publicity and customer relations from security vulnerabilities and/or mitigation techniques, including as a result of side-channel exploits such as “Spectre” and “Meltdown,” which could adversely impact our results of operations, customer relationships, and reputation. Separately, the publicity around recently disclosed security vulnerabilities may result in increased attempts by third parties to identify additional vulnerabilities, and future vulnerabilities and mitigation of those vulnerabilities may also adversely impact our results of operations, customer relationships, and reputation.

- Intel’s results could be affected by litigation or regulatory matters involving intellectual property, stockholder, consumer, antitrust, disclosure and other issues. An unfavorable ruling could include monetary damages or an injunction prohibiting Intel from manufacturing or selling one or more products, precluding particular business practices, impacting Intel’s ability to design its products, or requiring other remedies such as compulsory licensing of intellectual property.

- Intel’s results may be affected by the timing of closing of acquisitions, divestitures and other significant transactions.

Additional information regarding these and other factors that could affect Intel’s results is included in Intel’s SEC filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our Investor Relations website at www.intc.com or the SEC’s website at www.sec.gov.

Neueste Kommentare

13. Juli 2025

13. Juli 2025

13. Juli 2025

8. Juli 2025

7. Juli 2025

5. Juli 2025