(Auszug aus der Pressemitteilung)

Corsair Gaming, Inc. (Nasdaq: CRSR) (“Corsair” or the “Company”), a leading global provider and innovator of high-performance products for gamers, streamers, content- creators, gaming PC builders and SIM driving enthusiasts, today announced its financial results for the second quarter ended June 30, 2025. Corsair delivered another strong quarter, achieving double-digit growth in revenue and gross profit, expanded margins, and broad-based demand strength across its

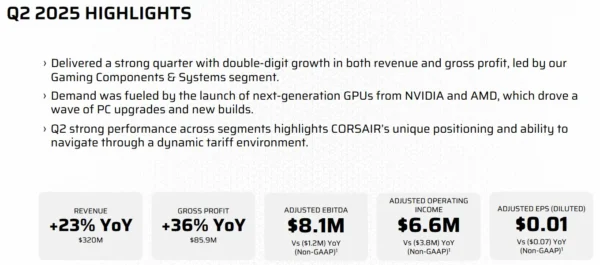

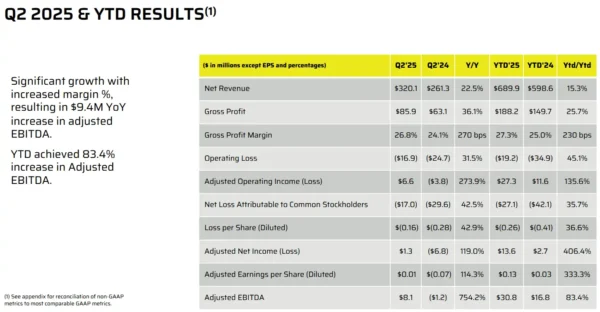

Q2 2025 Financial Highlights (compared to Q2 2024)

- Revenue increased 23% to $320 million, above consensus.

- Gross profit increased 36% to $85.9 million, reflecting improved product mix, favorable channel performance, and increased operational efficiency.

- Adjusted EBITDA improved to $8.1 million from a loss of $1.2, also above consensus

- Net Income (loss) per share attributable to common stockholders improved to $(0.16) / $0.01 per diluted share on a GAAP / Non-GAAP basis, compared to $(0.28) / $(0.07), respectively.

First Half 2025 Financial Highlights (compared to First Half 2024)

- Revenue increased 15% to $690 million.

- Gross profit increased 26% to $188.2 million, reflecting improved product mix, favorable channel performance, and increased operational efficiency.

- Adjusted EBITDA improved 83% to $30.8 million.

- Net Income (loss) per share attributable to common stockholders improved to $(0.26) / $0.13 per diluted share on a GAAP / Non-GAAP basis, compared to $(0.41) / $0.03, respectively.

Definitions of the non-GAAP financial measures used in this press release and reconciliations of such measures to their nearest GAAP equivalents are included below under the heading “Use and Reconciliation of Non-GAAP Financial Measures.”

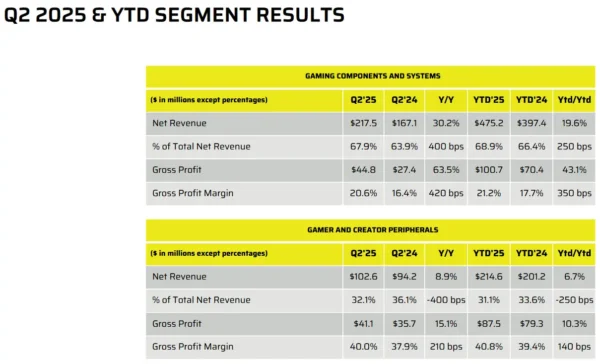

Business Segment Highlights

Gaming Components & Systems Segment – 30% Year-Over-Year Revenue Growth:

The Gaming Components & Systems segment achieved 30% year-over-year revenue growth, largely driven by the launch of NVIDIA’s 5000 series and AMD’s 9000 series next-generation GPUs. These high-performance hardware releases, paired with the launch of graphically intensive titles such as Doom: The Dark Ages and Elder Scrolls IV Remastered, featuring advanced ray tracing and 8K support, fueled greater demand among performance-focused PC builders. This convergence of cutting-edge graphics technology and next-gen game experiences served as a catalyst for system upgrades and new builds, reinforcing Corsair’s position at the center of the gaming enthusiast ecosystem.

Corsair’s Memory business achieved strong, double-digit year-over-year revenue growth, that was driven by sustained demand for high-performance DDR5 DRAM in both high-speed and high-capacity configurations. Our strong presence in the gaming enthusiast and system integrator channels continued to reinforce Corsair’s leadership in the premium memory market, making it a top choice for next-gen PC builds and upgrades.

Gamer Peripherals and Creator Segment – 9% Year-Over-Year Revenue Growth:

The Gamer Peripherals and Creator segment delivered 9% year-over-year revenue growth, supported by successful new product launches and ongoing investment in channel expansion. According to third-party analysts, Corsair gained market share in both keyboard and headset categories, which we believe was evidence of positive customer response to the latest product releases.

Corsair began the global rollout of its Fanatec-branded racing products through expanded channel partners late in Q2. Early sell-through and engagement metrics point to strong initial market adoption, signaling Corsair’s successful entry into the rapidly growing sim racing category. This momentum is further amplified by the global surge in Formula 1 popularity, which continues to drive mainstream interest in highly realistic racing experiences.

Elgato continued to lead the streaming and content creation market in Q2, supported by sustained demand for its award-winning Stream Deck and video capture solutions. The launch of the Nintendo Switch 2 has been a strong catalyst for increased gaming-related content creation, driving increased adoption of Elgato products across both professional and aspiring creators. With a significant market share in the streaming hardware category and a marketplace platform with thousands of useful products, Elgato is uniquely positioned to benefit from the accelerating global expansion of the creator economy.

Management Commentary:

Thi La, Chief Executive Officer of Corsair, commented, “Q2 2025 marked another solid quarter, with strong growth led by disciplined execution across product development, business operations, and go-to-market strategy. I am proud to see our team continue to deliver innovative, impactful experiences for our customers, while managing through macroeconomic challenges. This underscores Corsair’s resilience, focus and commitment to driving long-term growth.”

“Looking ahead, we are prioritizing three key strategic growth levers: accelerating the delivery of innovative products for our community of enthusiasts and content creators, expanding operational efficiency from recent acquisitions to help drive margin expansion, and scaling up our presence across underserved channels. I’m especially encouraged by the momentum we’re seeing in Asia this quarter, where our targeted investments are already delivering measurable returns and reinforcing the region’s long-term growth potential.”

“Our product showcase at Computex 2025 was one of Corsair’s most exciting launches. Among multiple awards received, we introduced our groundbreaking Virtual Stream Deck technology, which is integrated into the Corsair Scimitar Elite MMO gaming mouse and Xeneon Edge companion display. This innovation allows users to project a fully interactive Stream Deck interface directly onto a monitor, unlocking unparalleled shortcut customization and real-time control for both gamers and content creators. On the systems side, we recently unveiled our ORIGIN PC AI Workstation 300, a compact, 4.4L AI-ready system powered by the AMD Ryzen™ AI Max 300 Series. This product is designed for quiet efficiency, supports local LLMs, creative workloads, and AI development straight out of the box, offering professionals, creators, and developers a compelling new productivity solution. Importantly, these exciting new products are just the beginning; we expect future product launches will unlock even greater synergy across the entire Corsair ecosystem.”

“As global tariff policies continue to evolve, our focus remains on being agile. We’ve proven our ability to adapt and minimize disruption through supply chain optimization and diversified sourcing. That said, depending on how the semiconductor tariffs plays out, we may need to adjust pricing accordingly to preserve margin integrity. Our priority is to minimize customer impact, while continuing to deliver high-performance, industry-leading products.”

Michael G. Potter, Chief Financial Officer of Corsair, added, “We delivered double-digit revenue growth and EBITDA expansion, despite external headwinds, which included a $1.4 million bad debt expense. We believe that we have mitigated or will shortly mitigate the new country specific tariffs and the net impact in Q2 was small. As a result, we do not expect a large net impact for the rest of the year for the known and announced tariffs. Finally, we made an additional $24 million term loan repayment in Q2 and proactively refinanced our existing revolving and term loan credit facility ahead of schedule on very favorable terms and conditions in support of Corsair’s growth plan.”

Updated Full-Year 2025 Outlook

Corsair is reaffirming the net revenue outlook issued on February 12, 2025 for net revenue to be in the range of $1.4 billion to $1.6 billion for the full year 2025.

The Company intends to provide an updated adjusted operating income and adjusted EBITDA outlook later this year if macro factors including developments in global trade policy, such as the implementation of additional potential country-specific and sectoral tariffs, afford us greater visibility on our operating results.

The Company’s full-year 2025 outlook only reflects the impact or anticipated impact from tariffs announced to this date. The information provided above is based on Corsair’s current estimates and is not a guarantee of future performance. These statements are forward-looking and actual results may differ materially. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause Corsair’s actual results to differ materially from these forward-looking statements.

Recaro Aer Gaming-Stuhl zu gewinnen!

Recaro Aer Gaming-Stuhl zu gewinnen!

Neueste Kommentare

10. August 2025

8. August 2025

5. August 2025

1. August 2025

21. Juli 2025

19. Juli 2025