(Auszug aus der Pressemitteilung)

SUNNYVALE, Calif. — Oct. 15, 2009 – AMD[1] (NYSE:AMD) today reported revenue for the third quarter of 2009 of $1.396 billion. Third quarter 2009 revenue increased 18 percent compared to the second quarter of 2009 and decreased 22 percent compared to the third quarter of 2008.

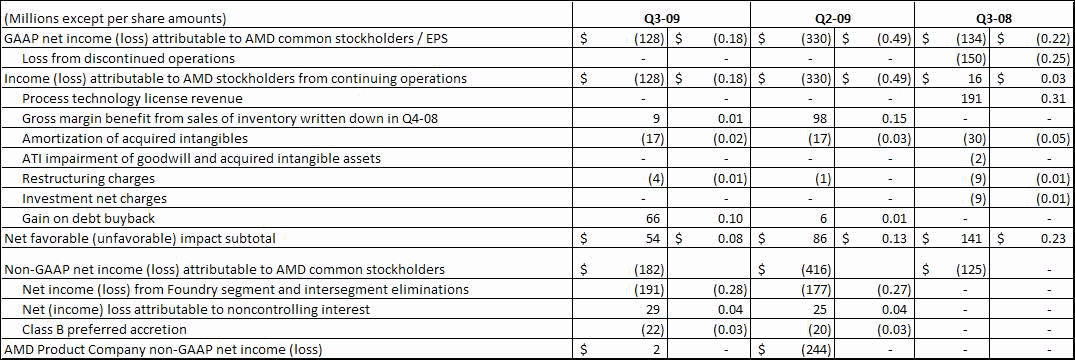

In the third quarter of 2009, AMD reported a net loss attributable to AMD common stockholders of $128 million, or $0.18 per share, which includes a net favorable impact of $54 million, or $0.08 per share, primarily from a $66 million gain from the repurchase of debt as described in the table below[2]. AMD’s operating loss was $77 million.

In the second quarter of 2009, AMD had revenue of $1.184 billion, a net loss attributable to AMD common stockholders of $330 million and an operating loss of $249 million. In the third quarter of 2008, AMD had revenue from continuing operations of $1.797 billion, a net loss attributable to AMD common stockholders of $134 million and an operating income of $122 million.

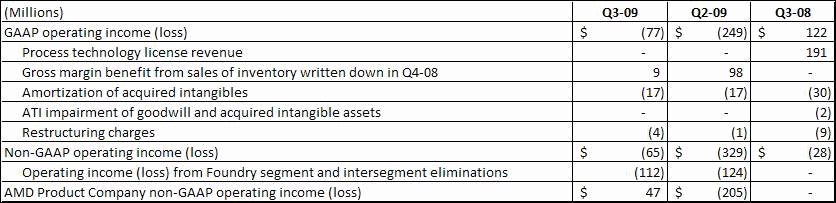

In the third quarter of 2009, AMD Product Company reported non-GAAP net income of $2 million and non-GAAP operating income of $47 million. In the second quarter of 2009, AMD Product Company reported a non-GAAP net loss of $244 million and a non-GAAP operating loss of $205 million[3].

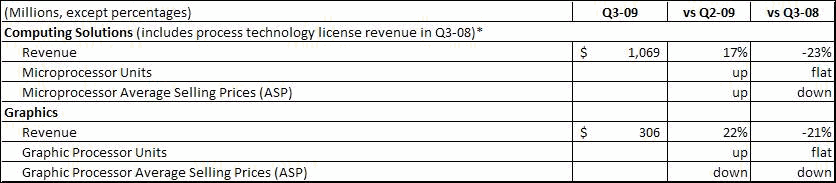

“Strong demand for our product and platform offerings combined with disciplined execution resulted in AMD Product Company achieving profitability in the third quarter,” said Dirk Meyer, AMD president and CEO. “Growth in microprocessor and graphics unit shipments drove an 18 percent sequential revenue increase, while improved factory utilization rates, higher microprocessor average selling price and an increase in 45nm product shipments resulted in a gross margin improvement from the prior quarter.”

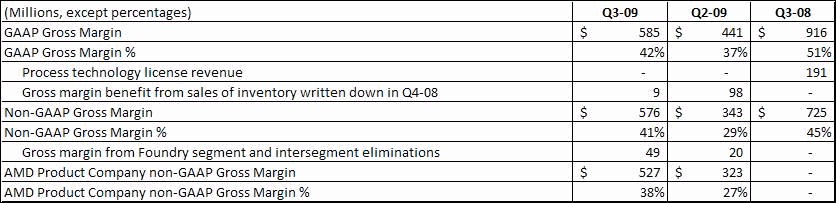

Third quarter 2009 AMD gross margin was 42 percent compared to 37 percent in the prior quarter. Third quarter 2009 AMD Product Company non-GAAP gross margin was 38 percent compared to 27 percent in the prior quarter.

Current Outlook

AMD’s outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under the “Cautionary Statement” below.

AMD expects its Product Company revenue to be up modestly for the fourth quarter of 2009.

Additional Highlights

- AMD introduced the ATI Radeon HD 5000 family of graphics processors, the industry’s only graphics chips that support the DirectX11 technology featured in Microsoft’s upcoming Windows 7 operating system. The flagship ATI Radeon™ HD 5870 captured the graphics performance title and has won more than 50 industry awards to date. The new ATI Radeon HD 5000 family of graphics cards also includes ATI Eyefinity multi-display technology, allowing a single graphics card to drive up to six monitors.

- AMD delivered several new computing platforms in the quarter.

- For the notebook market, global computer manufacturers including HP, Acer, Toshiba, Asus and MSI announced plans to introduce more than 70 notebooks based on AMD’s latest mainstream and ultrathin platforms.

- For the server market, AMD began shipping server platforms with the introduction of three new AMD server chipsets.

- For the commercial client market, HP began selling the Compaq 6005 Pro Business PC based on the new AMD Business Class Desktop Platform.

- For the embedded market, AMD announced dual- and quad-core platforms for client and high-end commercial embedded solutions.

- AMD launched VISION Technology from AMD, a differentiated approach to retail merchandising designed to reinforce the value proposition of AMD platforms and simplify the consumer buying experience by highlighting what can be done with a PC rather than what is inside the PC.

- AMD launched the AMD Fusion Partner Program, a business acceleration program designed to help AMD channel partners gain sales traction and speed the delivery of AMD platforms.

- AMD joined with GLOBALFOUNDRIES to break ground on Fab 2 in New York, GLOBALFOUNDRIES’ state-of-the-art semiconductor manufacturing facility that AMD expects will provide additional leading-edge manufacturing capacity when the facility enters production, scheduled for 2012.

Reconciliation of GAAP Net Income (Loss) Attributable to AMD Common Stockholders to AMD Product Company Non-GAAP Net Income (Loss) [1],[2],[3],[4]

Reconciliation of GAAP to AMD Product Company Non-GAAP Operating Income (Loss) [1],[2],[3],[4]

Reconciliation of GAAP to AMD Product Company Non-GAAP Gross Margin [1],[2],[3],[4]

Select Segment Information [4]

* Computing Solutions Q3-09 revenue decreased 11% compared to Q3-08, excluding the $191 million process technology license revenue in Q3-08.

[1] For financial reporting purposes, AMD consolidates the operating results of GLOBALFOUNDRIES Inc. in its results as of March 2, 2009 and created the Foundry segment as of the start of the fiscal year. References to “AMD” in this announcement include these consolidated operating results which are reported for GAAP purposes. “AMD Product Company” refers to AMD, excluding the operating results of the Foundry segment and Intersegment eliminations. Foundry segment includes the operating results attributable to the front end wafer manufacturing operations and related activities as of the beginning of the first quarter of 2009, which includes the operating results of GLOBALFOUNDRIES from March 2, 2009 through September 26, 2009. Intersegment eliminations consist of revenues, cost of sales and profits on inventory between AMD Product Company and the Foundry segment.

[2] In this press release, in addition to GAAP financial results, the Company has provided non-GAAP financial measures for AMD net income (loss) attributable to AMD common stockholders, operating income (loss) and gross margin. These non-GAAP financial measures reflect certain adjustments as presented in the tables in this press release. Management believes this non-GAAP presentation makes it easier for investors to compare current and historical period operating results by, among other things, excluding items that are not indicative of ongoing operating performance.

[3] The Company is providing non-GAAP financial measures for AMD Product Company such as a statement of operations and selected balance sheet items as reflected in this press release. In addition, for AMD Product Company, the Company is providing non-GAAP financial measures such as net income (loss), operating income (loss) and gross margin which exclude certain adjustments as reflected in the tables above. AMD is providing these financial measures because it believes it is important for investors to have visibility into AMD’s financial results excluding the Foundry segment, intersegment eliminations and certain adjustments as reflected in the tables in this press release and to better understand the Company’s financial results absent the requirement to consolidate the financial results of GLOBALFOUNDRIES.

[4] Refer to corresponding tables at the end of this press release for additional AMD and AMD Product Company data.

Neueste Kommentare

5. Dezember 2025

5. Dezember 2025

5. Dezember 2025

5. Dezember 2025

4. Dezember 2025

2. Dezember 2025