(Auszug aus der Pressemitteilung)

LONDON, April 21, 2008 – According to new preliminary data released by IDC EMEA, the first quarter of the year displayed very healthy trends for the PC industry in EMEA. Driven by continued strength in the notebook market in Western Europe and accelerated portable market expansion in the CEMA region (Central Eastern Europe, Middle East, and Africa), PC shipments recorded robust 19% growth compared with the same quarter in the previous year.

Notebooks continued to drive growth across the region with shipments recording an increase of over 43% year on year, while desktops suffered from the market contraction in Western Europe and declined by 1.7%, boosting the share of notebooks to over 55% of total EMEA shipments.

Demand for portable PCs remained strong in Western Europe as declining price points continued to assist SMB renewals and multiple equipment purchases in the consumer space. The competitive environment also intensified in the CEMA region, where vendors are driving increasing volumes and accelerating portable adoption.

“Despite its maturity, the Western European PC market showed no signs of slowing down as overall shipments increased by 12.6% year on year in 1Q08. Mobility undoubtedly remained the key engine of growth across both consumer and business segments. While the quarter started slowly, demand picked up in mid-February and, with a robust March, notebook shipments were boosted by over 30%, while desktop sales dropped by another 10%. The transition from desk-based to portable platforms accelerated further in the consumer space in particular, where notebooks were 70% of purchases,” said Eszter Morvay, senior research analyst for IDC’s EMEA PC tracker.

“The first quarter is traditionally buoyant with new product releases, which, coupled with strong vendor push and active marketing campaigns, stimulated accelerating notebook renewals. Competition, particularly with the arrival of Dell in the retail area, became even fiercer and the market continued to consolidate among the key international players. In addition, the growing share of etailers and the increasing presence of telco players, with the development of appealing Internet bundles, also contributed to price pressures and stimulated market expansion as well as multiple equipment purchases in European households, which is expected to be a key driving trend in 2008.”

Growth in CEMA did not show any sign of slowing down either, with an acceleration of portable adoption that contributed to boosting EMEA growth to the 19% observed this quarter.

“The first quarter of the year again saw very strong growth in the CEMA region with shipments recording 31.3% growth year on year, driven by continued demand for desktops and booming notebook sales,” said Stefania Lorenz, director, IDC CEMA Systems. “In contrast to declining trends in Western Europe, desktop sales continue to enjoy sustained growth in CEMA and represent over 50% of the market, with a 9.2% increase this quarter. This is driven by IT spending in the government and public sectors, SMB, and large enterprise segments. However, notebooks continue to grow at an impressive rate in both the CEE and MEA regions and exceeded expectations with an increase by 72.5% year on year in notebook shipments in 1Q08 for the two regions combined. Price competition among vendors is intensifying and, as prices for notebooks fall, they are becoming more affordable to home users who increasingly choose a notebook, rather than a desktop, as their first PC. International brands are strengthening their focus on the consumer market by selling through the major retail chains and shopping malls in some of the largest countries, while vendors also continue to increase their presence in the region through new alliances with distributors across countries.”

“EMEA will clearly remain a major growth opportunity in 2008. While further market commoditization is expected as prices continue to decline, the current evolution of the market, including from a user behavior standpoint, is creating huge opportunities for the IT industry.” said Karine Paoli, associate vice president, IDC EMEA Personal Computing group. “A large, and still growing, notebook installed base in the business market offers major replacement and up-sell opportunities, while the constant expansion and changing dynamics in the consumer space also offer major opportunities – faster replacement cycles and multiple equipment purchases – as well as differentiation as the market evolves towards increasing segmentation and usage scenarios.”

“The market will also benefit from an expansion of the available routes-to-market. Vendors will continue to reinforce their channel strategies to support their expansion and drive profitable growth, as the battle for share will remain fierce in the business segment, while on the consumer side, retail will continue to play a pivotal role in driving market expansion and new product adoption. However, focus will also be placed on better addressing the etailer channel and the development of mobile broadband offerings with telcos.”

“From a competitive environment standpoint, market concentration is likely to continue as vendors are looking at reinforcing their global capabilities and market reach, and as branding has become increasingly important. However, 2008 will continue to see a large number of players in the notebook space, with competition expected to be fierce among the major vendors while several other vendors will be looking at increasing their presence in EMEA and will potentially add pressure.”

Vendor Highlights

HP maintained a strong performance in EMEA and continued to drive robust growth, reaching 28% in 1Q08, thanks to solid execution across all segments, which allows the vendor to take over a 20% share of the total market. HP continued to drive share consolidation in the desktop space and robust share gains in both the commercial and consumer notebook market through an effective go-to-market, strong product portfolio, and aggressive pricing strategies.

Acer also continued to post strong gains and further reinforced its position in EMEA thanks to solid growth maintained in Western Europe, and outstanding growth of over 80% and 90% in CEE and MEA respectively, where the vendor maintains a strong expansion focus. The vendor also benefited this quarter from the share consolidation with Packard Bell, although with the acquisition still going through in 1Q, the vendor was not yet able to fully leverage from the larger scale it will offer over the next quarters and from the multibrand strategy the vendor will deploy.

Dell’s redefined strategy paid off and the vendor started 2008 posting over 70% growth of its consumer notebook sales in Western Europe in 1Q, which assists an overall solid performance at 21% in EMEA. The vendor’s entry in the retail channel recorded a very encouraging success with strong traction on the Dell brand and product portfolio. The vendor also continued to maintain strong positions in the business segment, while continued expansion in CEE and MEA also contributed to the vendor’s good quarter.

Fujitsu Siemens returned to positive shipment growth, albeit below market growth, driven by continued strength in the commercial notebook segment and healthy commercial desktop sales, especially in Germany where the vendor maintains a solid leadership. However, the consumer market remained challenging, as the vendor continues to suffer from the weakness of the consumer desktop market and fierce competition in the notebook space.

Toshiba continued to strengthen its fifth position in the overall EMEA ranking thanks to the strong position it maintained in the consumer notebook market in Western Europe, including in key countries such as the U.K. and Germany, though with a softer performance in France this quarter. However, the largest contributing factor for this quarter was the continued expansion of the vendor in CEMA, with over 80% growth achieved.

Lenovo, in sixth position, maintained strong performance in the commercial market across both desktop and notebook with over 30% shipment growth overall. Meanwhile, benefiting directly from the notebook market dynamics, Asus and Sony also displayed very healthy portable sales and continued to gain share in the region.

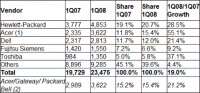

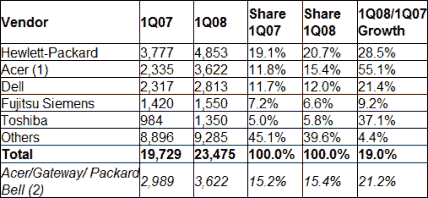

Top 5 Vendors: Europe, Middle East, and Africa (EMEA) PC Shipments*

1Q08 (Preliminary) (000 Units)

Source: IDC EMEA Quarterly PC Tracker, Preliminary Results, 1Q08, April 18, 2008

* PC shipments = desktop and notebooks.

(1) Acer shipments in 1Q08 include Acer, Gateway, and Packard Bell brands, following the recent acquisition by Acer of Gateway and Packard Bell.

(2) Acer, Gateway/eMachines and Packard Bell shipments for 1Q07 are provided here, aggregated in the additional row to allow easier year-on-year comparison. This is provided solely for comparison purposes, as the three companies were separate entities prior to the acquisitions.

Shipments are branded shipments for all form factors (including desktop and notebooks) and exclude x86 servers as well as OEM sales for all vendors. Data for all vendors is reported for calendar periods.

Neueste Kommentare

26. April 2024

19. April 2024

17. April 2024

17. April 2024

5. April 2024

23. März 2024