(Auszug aus der Pressemitteilung)

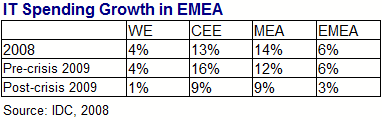

AMSTERDAM/PRAGUE, November 14, 2008 – IDC’s latest update on information technology (IT) spending in Europe, the Middle East, and Africa reveals a bleaker outlook for the near term in the wake of the worldwide financial crisis. Growth of just under 3% is now expected for the EMEA IT market in 2009, which represents a 1.5-point drop compared to IDC’s previous, pre-crisis forecast.

The downturn in the world economy is affecting demand for IT in both mature and emerging markets in EMEA, albeit somewhat differently. While IT spending in Western Europe will fall to just 1.2%, reflecting a sharp decline in capital investment with a contraction in GDP, the regions of Central and Eastern Europe and Middle East/Africa will continue to illustrate relatively healthy growth rates. “The IT market in Western Europe has moved into a phase of very sluggish growth for the foreseeable future,” said Marcel Warmerdam, research director, European IT Markets, and responsible for EMEA IT market research. “Many IT users are already resetting priorities in view of tougher times, with many projects being postponed or canceled.”

While EMEA’s emerging economies are also being affected by the crisis, they will be more resilient in the short term, and market growth will recover quicker, given demand fundamentals. “While growth in the IT markets of CEE and MEA regions will slow in 2009, affected by downturns in Russia, Turkey, and South Africa, we anticipate a sharp recovery already in 2010 in view of requirements for infrastructure development,” said Steven Frantzen, senior vice president for EMEA research. According to IDC, the IT markets in Central and Eastern Europe and Middle East and Africa will experience growth of 9.4% and 8.5%, respectively, in 2009.

In terms of technology sectors and demand, IDC expects discretionary spending on IT hardware to be the main focus of cutbacks in 2009. PC refresh cycles will be delayed while new planned projects will be postponed or scaled back and, as business growth is projected downward, demand for storage and servers will be weak. Sharply falling ASPs will also affect revenues. Growth of -2% is expected here for next year, with positive growth only resuming in 2011. Similarly, the growth rate for expenditure on software has been almost halved to 4.1% for 2009, reflecting IDC’s expectation that major business software upgrades will be delayed, particularly in the infrastructure space. The IT services market will also feel the recession as demand for project-oriented services will be affected, and pressure may abound to renegotiate existing outsourcing contracts.

“We are likely to see a major shift in the type of IT spending as users increasingly focus on cost reduction and gaining efficiencies,” said Warmerdam. “In fact, despite the troublesome short-term picture, there are a few silver linings.”

Examples of these silver linings include:

- Although the hardware market will have a hard time, some segments like IP phones and smart handhelds will continue to show double-digit growth rates.

- Open source software will get an extra boost as a means for organizations to cut back on license fees.

- The development of the software-as-a-service business model will gain momentum as its pay-per-use promise becomes a serious alternative for the current licensing model.

- The outsourcing market will get an extra boost, reflecting efforts to further reduce non-discretionary IT expenditure.

- Green IT and virtualization are measures to improve datacenter efficiencies that will enable companies to drive infrastructure costs down.

- Business continuity and IT security will require attention and investment regardless of the economic climate.

- The credit crisis will eventually bring on more regulation and associated compliancy efforts, which is an opportunity for the IT sector in terms of required storage, software, and data management investment.

IDC’s IT EMEA Black Book 2007-2012 provides an up-to-date forecast on ICT end-user spending for over 20 technologies for more than 50 EMEA countries. Drill downs are provided for hardware, software, IT services, and telecommunication services by geography.

Neueste Kommentare

26. April 2024

19. April 2024

17. April 2024

17. April 2024

5. April 2024

23. März 2024