(Auszug aus der Pressemitteilung)

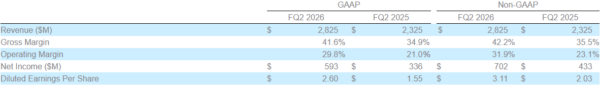

Fiscal Q2 2026 Highlights

- Revenue of $2.83 billion

- GAAP gross margin of 41.6%; non-GAAP gross margin of 42.2%

- GAAP diluted earnings per share (EPS) of $2.60; non-GAAP diluted EPS of $3.11

- Cash flow from operations of $723 million and free cash flow of $607 million

- Declared cash dividend of $0.74 per share

Seagate Technology Holdings plc (NASDAQ: STX) (the “Company” or “Seagate”), a leading innovator of mass-capacity data storage, today reported financial results for its fiscal second quarter ended January 2, 2026.

“Seagate’s December quarter results exceeded our expectations on both the top and bottom line, setting new records for gross margin, operating margin, and non-GAAP EPS. This performance highlights our team’s strong operational execution, the durability of data center demand, and the ongoing ramp of our HAMR-based Mozaic products,” said Dave Mosley, Seagate’s chair and chief executive officer.

“As AI applications amplify the creation and economic value of data, modern data centers increasingly need storage solutions that combine performance and cost-efficiency at exabyte-scale. Our areal-density-driven product roadmap positions us to meet the evolving storage requirements and exabyte demand growth, while creating significant value for our customers and shareholders for years to come,” Mosley concluded.

During the fiscal second quarter, the Company generated $723 million in cash flow from operations and $607 million in free cash flow. Seagate’s balance sheet remains healthy, and during the fiscal second quarter, the Company retired $500 million Exchangeable Senior Notes due 2028 and paid cash dividends of $154 million. As of the end of the quarter, cash and cash equivalents totaled $1.0 billion, and there were 218 million ordinary shares issued and outstanding.

Seagate has issued a Supplemental Financial Information document, which is available on Seagate’s Investor Relations website at investors.seagate.com.

Quarterly Cash Dividend

The Board of Directors of the Company (the “Board”) declared a quarterly cash dividend of $0.74 per share, which will be payable on April 8, 2026 to shareholders of record as of the close of business on March 25, 2026. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the Board.

Business Outlook

The business outlook for the fiscal third quarter 2026 is based on our current assumptions and expectations; actual results may differ materially as a result of, among other things, the important factors discussed in the Cautionary Note Regarding Forward-Looking Statements section of this release.

The Company is providing the following guidance for its fiscal third quarter 2026:

- Revenue of $2.90 billion, plus or minus $100 million

- Non-GAAP diluted EPS of $3.40, plus or minus $0.20

Our fiscal third quarter guidance includes:

- The estimated net dilutive impact from the Exchangeable Senior Notes due 2028; and

- Minimal expected impact from global tariff policies announced as of the date of this release.

Guidance regarding non-GAAP diluted EPS excludes known pre-tax charges related to estimated share-based compensation expenses of $0.23 per share.

We have not reconciled our non-GAAP diluted EPS guidance for fiscal third quarter 2026 to the most directly comparable GAAP measure, other than estimated share-based compensation expenses, because material items that may impact these measures are out of our control and/or cannot be reasonably predicted, including, but not limited to, net (gain) loss from debt transactions, strategic investment losses (gains) or impairment charges, income tax adjustments on these measures, and other charges or benefits that may arise. The amounts of these measures are not currently available but may be material to future results. A reconciliation of our historical non-GAAP financial measures to their nearest GAAP equivalent is contained in this release.

Neueste Kommentare

27. Januar 2026

27. Januar 2026

27. Januar 2026

24. Januar 2026

21. Januar 2026

20. Januar 2026