(Auszug aus der Pressemitteilung)

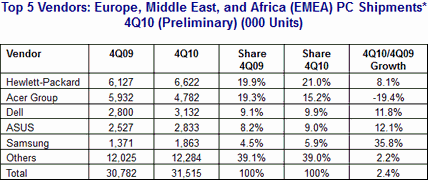

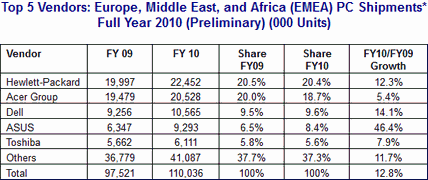

LONDON, January 20, 2011 – The PC market in Europe, the Middle East, and Africa (EMEA) recorded as expected a soft final quarter in 2010. Affected by the traction for new media tablets, which continued to have an adverse effect on consumer PC purchases, and cautious business investment, EMEA PC shipments grew by a modest 2.4% year-on-year in 4Q10, slightly below forecast at 4.3%, and reached a total of 31.5 million PCs during the quarter. Thanks to a strong first half of the year, growth for the year closed at a healthy 12.8% with over 110 million PC units shipped across EMEA in 2010.

In line with expectations, shipment levels in Western Europe remained constrained by weak consumer demand and declined by 7% year-on-year. Increasing traction for media tablets during the Christmas quarter contributed to divert consumers‘ attention and budgets away from PCs and led to a 10.5% overall decline for consumer PC purchases. The product category the most impacted remained Netbooks, which declined by 29%, but sales of mainstream notebooks were also affected and recorded a flat 0.5%. Traditional desktop sales suffered a severe drop of 19%, while growth in all-in-ones also slowed to only 1.8%.

Commercial sales held better, but following three quarters of rebound, growth returned to negative trends at -1.1%. Corporate demand continued to recover, helping to sustain commercial desktop volumes, but the SMB segment remained affected by economic pressure and uncertainty, forcing companies to prolong life cycles and delay renewals, impacting portables in particular. Commercial market performance varied substantially across countries, with a major drop in Spain and a decline of 3% in the U.K., while Germany and France remained positive, albeit at moderate levels.

„The hype around media tablets ramped up towards Christmas, as expected, and despite the launch of Samsung Galaxy and Toshiba Folio, Apple continued to dominate the European retail with the iPad,“ said Eszter Morvay, research manager of IDC’s EMEA Personal Computing group. „The robust popularity of media tablets led to further deceleration in mini notebook volumes as well as mainstream notebook demand due to constrained disposable income. The lackluster interest in notebook renewals continued fuel inventory build-up, despite slower sell-in in preparation for Sandy Bridge.“

Central Eastern Europe continued to post healthy growth as markets continue to recover and recorded a solid 20.4% compared against the same quarter last year, but growth was also constrained there by inventory levels built in 3Q. Growth in the Middle East outpaced expectations, however, with a healthy 22.9% year on year.

„The PC market in Central and Eastern Europe, the Middle East, and Africa (CEMA) recorded a year-on-year volume growth of 21.5% in 4Q10 to total 12.3 million units. Portable PC shipments, however, suffered from high inventory in the channel in Central and Eastern Europe (CEE) in the previous quarter, which inhibited growth in the notebook space to 27.0% in 4Q, falling short of the 33.2% forecast. Vendors such as Acer and Asus had among the highest stock levels of notebook vendors in 3Q,“ said Research Director Stefania Lorenz, IDC CEMA. „The desktop market reported healthier growth than forecast, however, at 10.4% year on year, thanks in part to HP’s push. The Middle East and Africa reported stronger results than anticipated, with year-on-year growth of 14.1% and 28.8% for desktops and notebooks, respectively, in 4Q10. The African region grew the most, boosted by several large PC deals.“

„While the arrival of new media tablets in 2010 caused some disruption in the traditional PC industry in the second half of the year, likely to continue in 1H11, it represents a major opportunity for the industry as it will drive device expansion and multi-equipment further, said Associate Vice President Karine Paoli, IDC EMEA Systems Infrastructure Solutions. „In the short-term, those devices will disrupt somewhat the traditional PC market space, but with no cannibalization expected with notebooks or ultra portables, which will remain the needed platforms for full computing for both consumer and business users, new media tablet devices constitute in the long-term a major opportunity for expansion for all vendors in the industry, and for those in particular that manage to establish themselves successfully in this new product segment and balance an extended device portfolio effectively.“

Vendor Highlights

HP closed a strong final quarter of the year and consolidated its leadership in EMEA across all subregions, while the vendor also regained the number 1 position in the EMEA portable PC market. The vendor outgrew overall EMEA market growth at a healthy 8.1% thanks to strong performance in the commercial segment in particular. Slower retail sales constrained overall consumer performance.

Acer remained constrained in 4Q by inventory levels and recorded a sharp drop in shipments. High inventory levels particularly in the retail channel prevented stronger sell-in across all subregions. In addition, the vendor suffered from a strong decline in mini notebook demand which contributed to significant volume contraction compared with the same quarter last year.

Dell maintained solid performance thanks to continued expansion across the emerging markets particularly in the Middle East and Africa. However, slower than expected commercial demand in Western Europe had a negative impact on the vendor’s overall performance.

Asus maintained fourth place thanks to healthy growth in Western Europe, despite further deceleration in mini notebook shipments, while results in emerging markets were constrained by an unfavorable year on year comparison.

Samsung recorded the strongest growth in the top 10 and made its entry into the top 5, driven primarily by expansion in CEMA as volumes remained constrained in Western Europe.

Beyond the Top 5, key performances this quarter also include Lenovo, which continued to post robust growth, further strengthening its position in the commercial market and maintaining sixth place, while Apple continued to perform strongly, benefiting from an ever-growing awareness of the Apple brand and the iPad boost. Toshiba maintained solid positions but posted softer growth impacted by a cautious sell-in due to large inventory levels from competition in the channel.

Source: IDC EMEA Quarterly PC Tracker, Preliminary Results, 4Q10, January 19, 2011

*PC shipments = desktop and notebooks.

Shipments are branded shipments for all form factors (including desktops and notebooks) and exclude x86 servers as well as OEM sales for all vendors. Data for all vendors is reported for calendar periods.

Source: IDC EMEA Quarterly PC Tracker, Preliminary Results, FY10, January 19, 2011

*PC shipments = desktop and notebooks.

Shipments are branded shipments for all form factors (including desktops and notebooks) and exclude x86 servers as well as OEM sales for all vendors. Data for all vendors is reported for calendar periods.

Neueste Kommentare

14. Februar 2026

12. Februar 2026

11. Februar 2026

10. Februar 2026

8. Februar 2026

6. Februar 2026