(Auszug aus der Pressemitteilung)

- QCT: Record Fiscal Year Revenues – Executing Towards our 2024 Investor Day Targets

- Total QCT Non-Apple Fiscal Year Revenues Grew 18% Year-Over-Year

- Combined QCT Automotive and IoT Fiscal Year Revenues Grew 27% Year-Over-Year

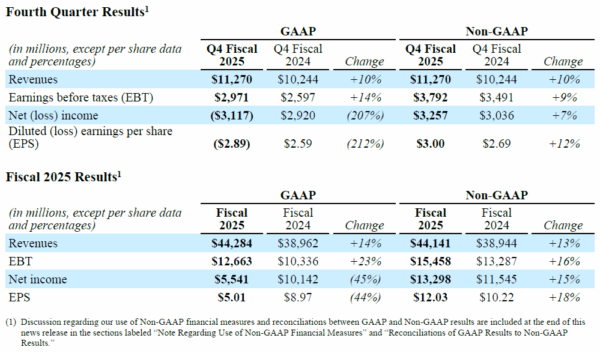

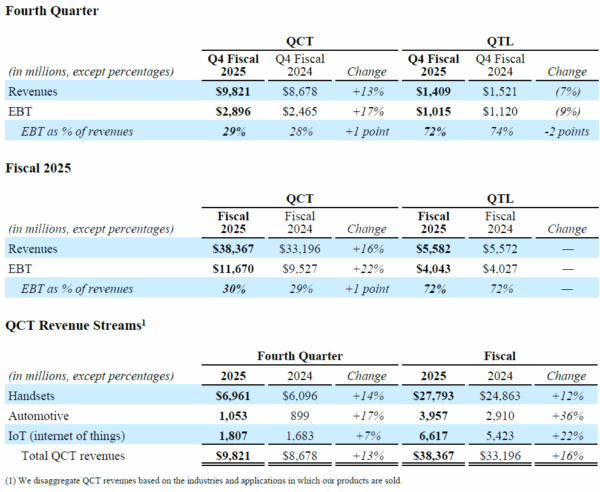

Qualcomm Incorporated (NASDAQ: QCOM) today announced results for its fiscal fourth quarter and year ended September 28, 2025. „Our business remains strong as demonstrated by record QCT revenues in fiscal 2025,” said Cristiano Amon, President and CEO of Qualcomm Incorporated. “We delivered 18% year-over-year growth in total QCT non-Apple revenues, with combined fiscal year Automotive and IoT revenue growth of 27%. We are excited about our business momentum, the availability of our automated driving stack, and our expansion to data centers and advanced robotics.”

Income Taxes

With the enactment of recent U.S. tax legislation in the One Big Beautiful Bill Act, we now expect our effective tax rate to generally remain in the 13% to 14% range and anticipate lower cash tax payments in future periods. However, this new tax legislation resulted in a non-cash $5.7 billion charge, or $5.29 per share, in the fourth quarter of fiscal 2025 to establish a valuation allowance against our U.S. federal deferred tax assets, as we now expect to be subject to the U.S. corporate alternative minimum tax beginning in fiscal 2026. This charge was excluded from our Non-GAAP metrics but impacted our GAAP results.

Segment Results

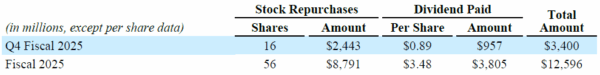

Return of Capital to Stockholders

The following table summarizes our return of capital to stockholders, through stock repurchases and cash dividends, during the fourth quarter and fiscal 2025.

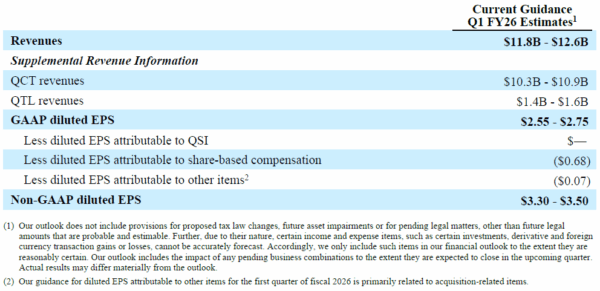

Business Outlook

The following statements are forward looking, and actual results may differ materially. The “Note Regarding Forward-Looking Statements” in this news release provides a description of certain risks that we face, and our most recent annual report on file with the Securities and Exchange Commission (SEC) provides a more complete description of our risks.

The following table summarizes GAAP and Non-GAAP guidance based on the current outlook.

Neueste Kommentare

6. Februar 2026

5. Februar 2026

5. Februar 2026

5. Februar 2026

4. Februar 2026

4. Februar 2026