(Auszug aus der Pressemitteilung)

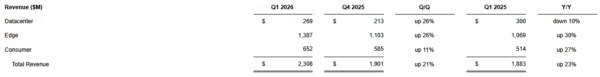

- Datacenter revenue was up 26% sequentially, with two hyperscalers in qualification, a third hyperscaler and top storage OEM planned for CY26, and engagement with five major hyperscale customers.

- BiCS8 technology accounted for 15% of total bits shipped; expected to reach majority of bit production exiting fiscal year 2026.

- Expect second quarter revenue to be in the range of $2.55 billion to $2.65 billion, with expected Non-GAAP diluted net income per share to be in the range of $3.00 to $3.40.

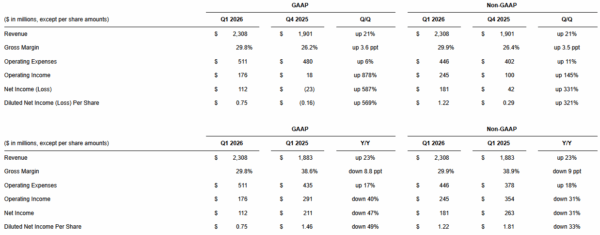

Sandisk Corporation (Nasdaq: SNDK) today reported fiscal first quarter financial results.

“Customers are turning to Sandisk for our leading technology and products, which are exceptionally well positioned at a time when demand is strengthening,” said David Goeckeler, CEO, Sandisk. “Our strong balance sheet and leading portfolio, combined with this phase of renewed growth and profitability, enabled us to achieve our net cash positive milestone ahead of plan and is positioning us to drive meaningful long-term value for our shareholders.”

Business Outlook for Fiscal Second Quarter of 2026

(1) Non-GAAP gross margin guidance excludes stock-based compensation expense and expense for short-term incentives granted in connection with the separation, totaling approximately $4 million to $6 million. The Company’s Non-GAAP operating expenses guidance excludes stock-based compensation expense and expense for short-term incentives granted in connection with the separation, totaling approximately $47 million to $63 million . The Company’s Non-GAAP interest and other expenses, net guidance excludes the accretion of the present value discount on consideration receivable from the sale of an interest in a subsidiary, totaling approximately $2 million. In the aggregate, Non-GAAP diluted net income per share guidance excludes these items totaling $49 million to $67 million. The timing and amount of these charges excluded from Non-GAAP gross margin, Non-GAAP operating expenses, Non-GAAP interest and other expenses, net, and Non-GAAP diluted net income per share cannot be further allocated or quantified with certainty. Additionally, the timing and amount of additional charges the Company excludes from its Non-GAAP diluted net income per share are dependent on the timing and determination of certain actions and cannot be reasonably predicted. Accordingly, full reconciliations of Non-GAAP gross margin, Non-GAAP operating expenses, Non-GAAP interest and other expenses, net, and Non-GAAP diluted net income per share to the most directly comparable GAAP financial measures (gross margin, operating expenses, and diluted net income per share, respectively) are not available without unreasonable effort.

(2) Non-GAAP tax expense is determined based on a Non-GAAP pre-tax income or loss. Our estimated Non-GAAP tax expense may differ from our GAAP tax expense (i) due to differences in the tax treatment of items excluded from our Non-GAAP net income or loss; (ii) due to the fact that our GAAP income tax expense or benefit recorded in any interim period is based on an estimated forecasted GAAP tax expense for the full year, excluding loss jurisdictions; and (iii) because our GAAP taxes recorded in any interim period are dependent on the timing and determination of certain GAAP operating expenses.

Neueste Kommentare

6. Februar 2026

5. Februar 2026

5. Februar 2026

5. Februar 2026

4. Februar 2026

4. Februar 2026