(Auszug aus der Pressemitteilung)

London, 4 December, 2009 – According to IDC’s EMEA Quarterly Server Tracker, EMEA server revenue in 3Q09 reached $2.9 billion, a decline of 25.7% year on year, with nearly half a million units shipped, 24.6% less than in the same quarter of 2008. Sequentially, revenue and units experienced growth of 1.9% and 8.4%, respectively, both measures exhibiting encouraging signs that the worst may be over in what has been the toughest server market environment since IDC records began. This quarter was the first time the EMEA server market posted sequential revenue growth since 4Q08.

By subregion, the Middle East and Africa (MEA) reached a double-digit revenue market share for the third consecutive quarter, with 11.7% of total revenue, while Central and Eastern Europe (CEE), slightly recovered quarter on quarter, but continued to have a lower market share than in 2008, with 10% of the total revenue. The figures confirm that market demand is growing in the Middle East and Africa while Central and Eastern Europe is taking longer to recover. Western European revenue accounted for 78.3% of the total EMEA sales.

Market momentum for x86 servers continued unabated, with revenue performance better than non-x86 servers. x86 revenue was down 21.3% annually and up 16.7% sequentially, with units up 9.6%. x86 revenue reached $1.7 billion, while non-x86 sales totaled $1.2 billion. Non-x86 revenue was down both annually and sequentially. Year on year, non-x86 revenue was down by 31.3%, while sequentially revenue was down by 14%. Shipments slumped, decreasing 49.5% in 3Q09 on 3Q08, confirming that non-x86 ASVs remain the highest in the market by a big margin. In terms of units, only 2.7% of all the servers shipped in EMEA were non-x86.

By server class, volume servers were again the main market engine with $1.7 billion, or 59.1% of the total EMEA revenue. Midrange servers, the majority of which belong to the RISC segment, suffered the sharpest decline of all sub-segments in 3Q09, 34.6% down annually, with less than $400 million in sales. High-end servers also declined by 30.2% year on year after surpassing $800 million in EMEA in 3Q09.

“Overall, the EMEA server market environment remains challenging despite better than expected performance in the larger countries such as the U.K., Germany, Spain, and to a lesser extent Russia,” said Nathaniel Martinez, director of IDC European Systems and Infrastructure Solutions. “Platform migrations, consolidation projects and datacenter rejuvenation investments are bringing some activity to the market place.

“Enterprise customers have slowly re-initiated server refreshments, either because of specific vendor roadmaps or simply to boost the flexibility and efficiency of the IT infrastructure, to increase their competitive edge in a toughening environment. The recent technology developments in x86 microprocessors helped drive demand in 3Q09, and 2010 will be a promising year in that area,” said Beatriz Valle, IDC analyst for European Systems and Infrastructures Solutions. “The sequential quarterly revenue growth is very subdued, but server vendors remain hopeful that things will pick up in the fourth quarter, which is traditionally strong in the corporate space due to end-of-year budget renewals. Fourth-quarter performance will be critical to measure where the market is heading in the medium term.”

Blade Market Dynamics

“The blade segment has been less impacted by the current market woes, as progress in blade technologies accelerates innovation in both the x86 and the non-x86 business segments,” said Giorgio Nebuloni, senior research analyst with IDC European Systems and Infrastructure Solutions. “Blades represented 16% of the x86 units, down from 16.3% in 2Q09, but thanks to their growing ASVs blade revenue was down only 6% year on year. IDC expects this product segment to see positive growth already in 4Q09, as new, integrated technology offerings relying on the blade platform see a good uptake. In this respect, non-x86 blades ($40.5 million in revenue in 3Q09, up 6% year on year) will become increasingly crucial, bringing Unix environments onto blade architectures.”

CEMA Highlights

“In the CEMA region, revenue was down 35.3% on the year and up 8.3% on the quarter, with units down 35.7% annually and up 18% quarterly. The x86 market was the engine behind quarterly growth, with 59.3% of total revenue and 97.5% of total shipments in 3Q09. But demand for industry standard servers varies by subregion, with 44.2% of total revenue in MEA belonging to the non-x86 market, while just 36.6% of total sales in CEE were related to the non-x86 business,” said IDC CEMA Systems Research Director Stefania Lorenz.

Market Highlights

- x86 server revenue was down 21.4% year on year and up 16.7% quarter on quarter. Revenue for industry standard servers reached $1.7 billion or 59.2% of the EMEA total in 3Q09. Despite sharp annual declines of 25%, EPIC servers experienced a resurgence quarter on quarter, up by a strong 19.7% to $300 million, and nearly on a par with CISC revenue now. RISC and CISC revenue were down both year on year and quarter on quarter. The RISC market share in EMEA declined by nearly five percentage points year on year.

- Of all the main operating systems, Unix recorded the sharpest annual decline, with revenue down 36.3% in 3Q09 on 3Q08. Windows and Linux recorded annual declines of 22.7% and 18%, respectively, with IBM’s mainframe operating system holding up relatively well, down 19.3% year on year.

- Windows maintained its revenue leading spot, with 43.6% of all the EMEA revenue, with Unix lagging well behind, at 25.9% of EMEA revenue, followed by Linux, with 16.9%. This means there is now a revenue differential of 16 full percentage points between the two main operating systems, the biggest ever recorded by IDC. Although Windows has been bidding for the top spot for years now, in 4Q08 both operating systems were still neck and neck, with 35% of the total market each.

- Blades continue to display extraordinarily robust performance when compared to other form factors. Annual revenue declines were just 5.2%, compared with the strong declines of 27.7% and 30.7% for pedestals and racks respectively. Quarter on quarter, blade revenue was up 17.4%, to nearly half a billion dollars. Blade revenue is now 15.8% of the total in EMEA, two full percentage points above the previous quarter and the highest it has ever been. The last time the blade market share decreased was in 3Q06.

- Regarding server class, volume server revenue reached $1.7 billion, down 23% year on year and up 12.3% quarter on quarter. Volume servers were 59.1% of the total revenue, with midrange server revenue just 12.9%. The vast majority of x86 servers were volume servers, with $1.6 billion in sales. High-end server revenue spread across the RISC, CISC, and EPIC segment, but the majority of midrange server revenue originated in the RISC segment.

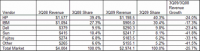

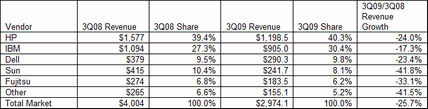

Vendor Highlights

- HP held the top revenue spot in EMEA for the seventh consecutive quarter in 3Q09, with over 40% of the market share thanks to the strong overall market demand of x86 technologies, which account for nearly 75% of the vendor’s sales. The industry-standard Proliant family was up 24.8% quarter on quarter, but down 16.9% year on year, with nearly $900 million. Integrity servers, based on Intel’s Itanium processor, were up 19.3% quarter on quarter, nearing $300 million in revenue.

- IBM managed to narrow the gap against HP by around two percentage points on the same quarter last year. The RISC-based Power Systems continued as the top revenue-generating server product for the company with well over $300 million, and the x86 family System x did very well, up 34.2% quarter on quarter and with 35.1% of the revenue, thanks to good performance in both blades and rack systems. Mainframes experienced both annual and quarterly declines.

- Helped by demand in x86, Dell was the only vendor to slightly increase its revenue market share year on year, albeit by a very small margin of 0.3%. The PowerEdge line reached nearly $300 million in revenue.

- Sun saw its market share decrease by more than two percentage points in 3Q09 over 3Q08, with its performance affected by the delays in the transactions over its sale to Oracle. Its RISC-based SPARC Enterprise family generated nearly 70% of the vendor’s revenue, and its Sun x86 line more than 20% of Sun’s revenue for the quarter.

- Fujitsu continued its push in the x86 arena, with sales of Primergy reaching in excess of $100 million and growing 7.9% quarter on quarter, despite an annual decline of 33.8%. Sales of its BS2000 mainframes neared $70 million and were up 15.8% quarter on quarter.

Top 5 Vendors, EMEA Server Factory Revenue, Third Quarter of 2009, Revenue in Millions

Source: IDC’s EMEA Quarterly Server Tracker, December 2009

Neueste Kommentare

19. April 2024

17. April 2024

17. April 2024

5. April 2024

23. März 2024

22. März 2024