(Auszug aus der Pressemitteilung)

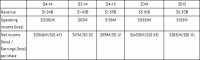

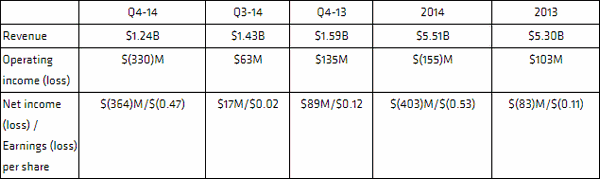

SUNNYVALE, CA — 01/20/15 – AMD (NASDAQ: AMD) today announced revenue for the fourth quarter of 2014 of $1.24 billion, operating loss of $330 million and net loss of $364 million, or $0.47 per share. Non-GAAP operating income was $36 million, non-GAAP net income of $2 million and breakeven non-GAAP earnings per share.

GAAP Financial Results

Non-GAAP Financial Results

„We made progress diversifying our business, ramping design wins and improving our balance sheet this past year despite challenges in our PC business,“ said Dr. Lisa Su, AMD president and CEO. „Annual Enterprise, Embedded and Semi-Custom segment revenue increased over 50% as customer demand for products powered by our high-performance compute and rich visualization solutions was strong. We continue to address channel headwinds in the Computing and Graphics segment and are taking steps to return it to a healthy trajectory beginning in the second quarter of 2015.“

2014 Annual Results

- Revenue of $5.51 billion, up 4 percent year-over-year.

- Gross margin of 33 percent, down 4 percentage points year-over-year and non-GAAP gross margin of 34 percent, down 3 percentage points year-over-year.

- Operating loss of $155 million and non-GAAP operating income of $235 million, compared to GAAP and non-GAAP operating income of $103 million in 2013.

- Net loss of $403 million, loss per share of $0.53, and non-GAAP net income of $51 million, non-GAAP earnings per share of $0.06, compared to a GAAP and non-GAAP net loss of $83 million, loss per share of $0.11 in 2013.

Q4 2014 Results

- Revenue of $1.24 billion, down 13 percent sequentially and 22 percent year-over-year.

- Gross margin of 29 percent and non-GAAP gross margin of 34 percent. Gross margin was down 6 percentage points sequentially, primarily due to lower of cost or market inventory adjustment of $58 million related to our second-generation APU products. Non-GAAP gross margin was down 1 percentage point sequentially. Q3 2014 gross margin of 35 percent included a $27 million, or 2 percent, benefit from revenue related to technology licensing.

- Operating loss of $330 million and non-GAAP operating income of $36 million, compared to operating income of $63 million and non-GAAP operating income of $66 million in Q3 2014.

- Net loss of $364 million, loss per share of $0.47, and non-GAAP net income of $2 million, breakeven non-GAAP earnings per share, compared to net income of $17 million, earnings per share of $0.02 and non-GAAP net income of $20 million, non-GAAP earnings per share of $0.03 in Q3 2014.

- Cash, cash equivalents and marketable securities were $1.04 billion at the end of the quarter, up $102 million from the end of the prior quarter.

- Total debt at the end of the quarter was $2.21 billion, flat from the prior quarter.

Financial Segment Summary

- Computing and Graphics segment revenue decreased 15 percent sequentially and 16 percent from 2013. The sequential decrease was primarily due to lower desktop processor and GPU sales, and the annual decrease was driven by lower desktop processor and chipset sales.

- Operating loss was $56 million, compared with an operating loss of $17 million in Q3 2014 and operating loss of $15 million in Q4 2013. The sequential and year-over-year decreases were primarily driven by lower channel sales partially offset by lower operating expenses.

- Client average selling price (ASP) increased sequentially and year-over-year primarily driven by a richer mix of notebook processor sales.

- GPU ASP increased sequentially primarily due to higher desktop and notebook GPU ASPs and decreased year-over-year primarily due to a lower channel ASP.

- Enterprise, Embedded and Semi-Custom segment revenue decreased 11 percent sequentially primarily driven by lower sales of semi-custom SoCs. Annual revenue increased 51 percent from 2013 primarily driven by increased sales of semi-custom SoCs.

- Operating income was $109 million compared with $108 million in Q3 2014 and $129 million in Q4 2013. The year-over-year decrease was primarily due to lower sales of semi-custom SoCs.

- All Other category operating loss was $383 million compared with $28 million in Q3 2014 and operating income of $21 million in Q4 2013. The sequential and year-over-year decreases are primarily due to a $233 million goodwill impairment charge, $71 million restructuring and other special charges, net and a $58 million lower of cost or market inventory adjustment.

Recent Highlights

- Strong demand continued for AMD-based game consoles, with Microsoft and Sony having shipped nearly 30 million consoles to-date. Sony also recently announced plans to release PlayStation®4 in the People’s Republic of China.

- AMD added „Carrizo“ and „Carrizo-L“ to its 2015 Mobile APU roadmap, giving customers a single platform that scales from high-performance notebook gaming PCs to mainstream laptops. With new energy efficiency features, next generation CPU cores and the latest GCN graphics, „Carrizo“ will be AMD’s most advanced APU ever when it comes to market in the first half of 2015.

- AMD drove continued adoption of high-performance APUs into new embedded markets with key new customer design wins, including:

- Two new solutions from QNAP, a leading provider of network attached storage (NAS) systems, powered by AMD’s Embedded G-Series SoC.

- Gizmosphere’s Gizmo 2, a second-generation, open source development board, powered by the AMD Embedded G-Series SoC, which offers outstanding compute and graphics performance on a single platform for a wide range of Linux and Windows based development projects.

- AMD-based systems continued building momentum in the commercial client market with the adoption of AMD PRO APU-based commercial systems — like the HP Elite 700-Series and Lenovo ThinkCentre M79 and M78 desktops — by companies worldwide, including China Mobile Communications Corporation, Dr. Pepper Snapple Group and Telcel (Mexico).

- AMD demonstrated continued progress developing the ecosystem for both 64-bit ARM-based servers and APU-based servers targeting next-generation workloads, with notable developments including:

- SUSE Linux’s release of openSUSE version 13.2, marking the first generally available Linux distribution offering direct support for AMD’s upcoming ARM-based processor, the AMD Opteron™ A1100 Series processor (codenamed „Seattle“).

- Penguin, in collaboration with AMD, announced the first application optimized APU clusters, enabling seamless GPU and CPU memory sharing on clusters based on heterogeneous system architecture (HSA).

- HP announced new HP ZBook 14 and HP ZBook 15u mobile workstations powered by AMD FirePro™ professional graphics at the 2015 International Consumer Electronics Show.

- AMD launched its Catalyst Omega driver suite, delivering performance increases of up to 19 percent on AMD Radeon™ graphics and up to 29 percent on AMD APUs,(3) more than 20 new features, like Virtual Super Resolution, and improvements based on user feedback, as well as a set of new developer tools and Linux optimizations. Downloads to date total 8.8 million.

- Demonstrating thought leadership in gaming and graphics, AMD introduced AMD FreeSync technology,(4) an innovative, open-standards-based screen synching technology that maximizes the reduction of input latency and reduces or fully eliminates stuttering and tearing during gaming and video playback on select AMD Radeon™ graphics cards and current and future generation APUs. FreeSync-enabled displays from BenQ, LG Electronics, Nixeus, Samsung and Viewsonic were showcased at the 2015 International Consumer Electronics Show and are expected to be available in market starting in the first quarter of 2015.

- AMD announced, for the third straight year, research grants totaling more than $32 million for the development of critical technologies needed for extreme-scale computing in conjunction with projects associated with the U.S. Department of Energy (DOE). The two DOE awards will fund research on exascale applications for AMD APUs based on the open-standard HSA, as well as future memory systems to power a generation of exascale supercomputers.

- AMD achieved recognition as a world leader in energy efficiency and compute power with AMD FirePro™ professional graphics being awarded the top spot on the Green500 List, a ranking of the world’s most energy-efficient supercomputers, and the AMD Opteron™ server CPU receiving the number two spot on the latest TOP500 List, a ranking of the 500 most powerful supercomputers in the world.

Current Outlook

AMD’s outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under „Cautionary Statement“ below.

For Q1 2015, AMD expects revenue to decrease 15 percent, plus or minus 3 percent, sequentially.

Neueste Kommentare

8. März 2026

8. März 2026

8. März 2026

6. März 2026

6. März 2026

4. März 2026